Health Insurance During Long-Term Disability: Understanding Your Coverage Options

Understand health insurance during long term disability

When face a long term disability, maintain health insurance coverage become critically important. Medical bills can pile up rapidly, peculiarly when you’re already dealt with reduced income. The question of who pay for health insurance while on long term disability is complex and depend on several factors, include your employer’s policies, the type of disability coverage you’ve, and applicable laws.

Employer responsibilities for health insurance

Many employees wonder if their employer must continue to provide health insurance coverage when they go on long term disability leave. The answer vary base on company size, policy details, and legal requirements.

FMLA protection period

Under the family and medical leave act (fFMLA) eligible employees can take astir to 12 weeks of unpaid leave for serious health conditions while maintain their health insurance coverage. During this period, employers must cocontinue to provideealth insurance under the same terms as if the employee were notwithstanding work.

This mean your employer must continue to pay their portion of your health insurance premiums during FMLA leave. Notwithstanding, you remain responsible for your share of the premiums. If you fail to pay your portion, your employer may terminate your coverage after provide notice.

Beyond FMLA

Once FMLA leave expire, employer obligations change. Some employers voluntarily extend health insurance benefits beyond the FMLA period, while others don’t. This extension period vary wide among companies, range from a few additional months to the entire duration of approve disability leave.

Check your employee handbook or benefits policy to understand your employer’s specific approach to health insurance continuation during disability leave. Some companies maintain coverage for 6 12 months after disability begin, while others may cut off benefits soon after FMLA expire.

Large employers vs. Small businesses

Company size affect health insurance obligations during disability leave. Large employers (50 + employees )must comply with fmFMLAequirements, while smaller companies may have different policies. Additionally, some states have enenactedaws that expand on federal requirements, provide more extensive protections for employees on disability leave.

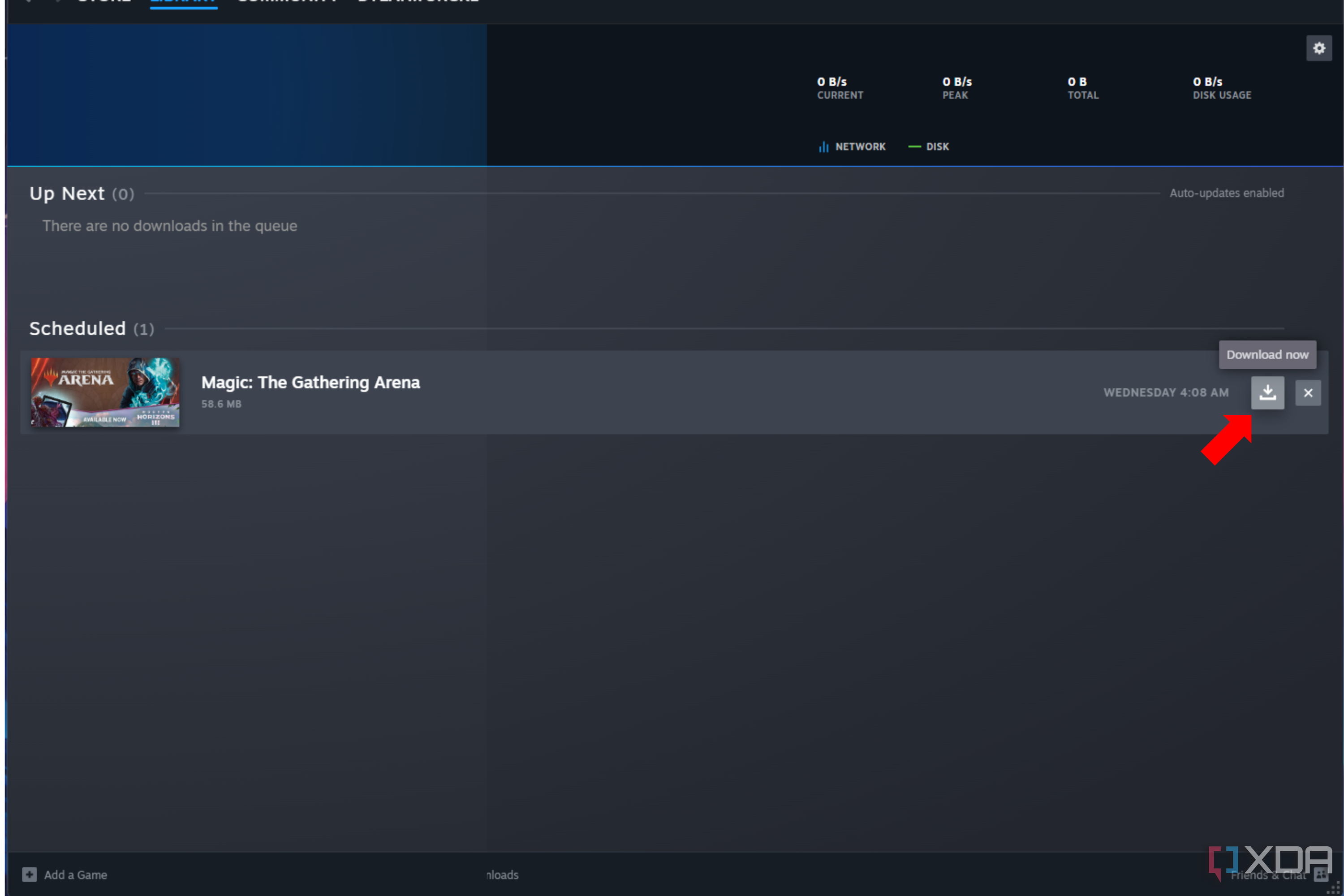

Cobra coverage options

When employer sponsor health insurance end during long term disability, cobra (consolidated omnibus budget reconciliation act )become an important option. Cobra allow you to maintain the same health insurance plan for a limited period, typically up to 18 months, though you become responsible for the entire premium cost plus a 2 % administrative fee.

How cobra work during disability

If your employer stop pays their portion of your health insurance premiums, they must offer cobra continuation coverage. Thisappliesy to companies with 20 or more employees. Under cobryou willill receive the same health benefits you’d while actively will employ, but at an importantly higher cost.

The transition to cobra coverage can be jarring financially. When actively employ, many workers pay exclusively 20 30 % of their premium costs, with employers cover the remainder. Under cobra, you become responsible for 100 % of the premium plus the administrative fee, which can amount to hundreds or eventide thousands of dollars monthly.

Cobra extensions for disability

A special provision exists for those who qualify as disabled under social security standards. If the social security administration determine you’redisablede within the first 60 days of cobra coverage, you may qualify for a11-monthth extension beyond the standard 18 months, for a total of 29 months of coverage.

During the extension period, premiums may increase to 150 % of the plan’s cost. While expensive, this extension can provide crucial coverage until medicare eligibility begin for those on social security disability insurance (sSDI))

Short term vs. Long term disability insurance

Understand the difference between short term and long term disability insurance helps clarify who pay for health insurance during disability periods.

Short term disability

Short term disability (std )typically cover the initial phase of disability, commonly last 3 6 months. During this period, most employers continue health insurance coverage as they’d for an active employee. You remain responsible for your regular premium contribution, which may bebe deductedrom your disability payments.

Std benefits unremarkably replace 60 70 % of your base salary. This period oftentimes align with FMLA protection, mean your job and benefits remain protect.

Long term disability

Long term disability (ltd )begin when std benefits end, potentially last for several years or until retirement age. During ltd, employer obligations regard health insurance vary importantly. Many employers discontinue their premium contributions after a certain period, typically 6 12 months from the disability onset.

Ltd policies loosely don’t include provisions for health insurance premium payments. They focus on income replacement instead than benefits continuation. This creates a gap many disabled workers must navigate cautiously.

Disability insurance and health premium payments

Some disability insurance policies include provisions for health insurance premium payments, but this isn’t standard. Premium waiver benefits are more common than health insurance premium coverage.

Private disability policies

Individual disability insurance policies purchase privately sometimes offer riders or provisions that help cover health insurance costs during disability. These specialized features must be specifically included in your policy and typically increase your premium costs.

If you have a private disability policy, review it cautiously to determine if iincludesde any health insurance premium support. Some policies offer lump sum benefits that can useduse for any purpose, include pay for health insurance.

Employer sponsored disability plans

Employer provide disability insurance seldom cover health insurance premiums straightaway. Alternatively, these plans focus on replace a portion of your income. You’re expected to use this income replacement to pay for ongoing expenses, include your share of health insurance premiums.

Some employer disability plans coordinate with benefits departments to arrange premium payments through disability benefit deductions, simplify the process for disabled employees.

Social security disability and medicare

Social security disability insurance (sSDI))rovide another avenue for health insurance coverage, though with significant timing considerations.

Medicare eligibility through SDI

After receive SDI benefits for 24 months, you become eligible for medicare irrespective of age. This ttwo-yearwaiting period create a potential gap in coverage that must be address through other means, such as cobra, a spouse’s plan, or marketplace insurance.

The medicare benefit include hospital insurance (part a )at no cost and medical insurance ( (rt b ) )r a monthly premium. For those with limited financial resources, additional assistance programs may help cover medicare costs.

Bridge the gap to medicare

Plan for the 24-month waiting period between SDI approval and medicare eligibility is crucial. Options during this period include:

- Continue employer coverage through cobra

- Join a spouse’s or family member’s health plan

- Purchase coverage through the health insurance marketplace

- Apply for medicaid if income and asset levels qualify

Each option have different costs and benefits that should be cautiously evaluated base on your specific medical needs and financial situation.

Health insurance marketplace options

The Affordable Care Act (aACA)create another option for those on long term disability through the health insurance marketplace.

Special enrollment periods

Lose employer sponsor health coverage due to disability trigger a special enrollment period, allow you to purchase a marketplace plan outside the standard enrollment window. This period last 60 days from the loss of previous coverage.

During this time, you can compare plans and potentially qualify for premium tax credits and cost sharing reductions base on your reduce income while on disability.

Source: disabilityhelp.org

Premium subsidies

Many individuals on disability qualify for substantial premium assistance through the marketplace. With reduced income from disability benefits, you may be eligible for premium tax credits that importantly lower monthly costs.

For those with income below 250 % of the federal poverty level, additional cost sharing reductions can lower deductibles, co-payments, and out of pocket maximums, make healthcare more affordable during disability.

Negotiate with your employer

When face long term disability, proactive communication with your employer can sometimes yield better health insurance outcomes.

Extended benefits arrangements

Some employers are willing to negotiate extend health benefits beyond their standard policy, particularly for value employees with good work histories. This might include maintain coverage at employee rates for an extended period or offer a lump sum to help cover cobra premiums.

These arrangements aren’t lawfully require but represent goodwill gestures some companies extend. Approach these discussions professionally and focus on your continue commitment to return to work when possible can improve your chances of success.

Document agreements

If your employer agrees to continue health insurance coverage during disability, get the agreement in writing. This documentation should specify:

- Duration of extended coverage

- Premium amount and responsibility for payment

- Process for make premium payments

- Conditions that might change the agreement

- Notification requirements for any changes

Write documentation protect both parties and prevent misunderstandings during an already stressful period.

State disability programs and health insurance

Several states offer their own disability programs, which may interact otherwise with health insurance coverage.

State temporary disability insurance

California, Hawaii, New Jersey, New York, Rhode Island, and Washington (plus pPuerto Rico)have mandatory state disability insurance programs. These programs provide short term benefits but loosely don’t straightaway address health insurance continuation.

Notwithstanding, receive state disability benefits may help you qualify for state specific health insurance programs or subsidies. Check with your state’s disability office to understand how these programs interact with health insurance options.

State continuation laws

Some states have enact” ” mini cobr” laws that extend continuation coverage requirements to smaller employers not cover by federal cobra regulations. These state laws vary wide in terms of:

- Duration of require continuation coverage

- Qualifying events that trigger coverage rights

- Premium limitations

- Employer size requirements

Contact your state’s insurance department to understand specific protections available in your location.

Plan for health insurance during disability

Proactive planning can prevent health insurance gaps during disability periods.

Emergency fund considerations

Build an emergency fund that include potential cobra or marketplace premium costs provide financial security during disability. Financial advisors frequently recommend set away 3 6 months of expenses, include potential health insurance costs if employer coverage end.

Source: bartleby.com

This preparation is specially important to give the typical waiting periods for long term disability benefits to begin and the potential gaps before medicare eligibility throuSDIsdi.

Disability insurance evaluation

When select disability insurance, consider policies that offer higher benefit amounts or specific provisions for health insurance continuation. The somewhat higher premiums for enhanced coverage may prove worthwhile if you experience a long term disability.

Some disability insurance providers offer supplemental benefits specifically design to help cover health insurance costs during disability. These specialized features can provide valuable protection for your healthcare coverage.

Practical steps when face long term disability

If you’re transition to long term disability status, take these practical steps to protect your health insurance coverage:

- Review your employee handbook and benefits documentation to understand your employer’s specific policies.

- Meet with your hr department to discuss health insurance continuation options and get write confirmation of arrangements.

- Will calculate the potential cost of cobra coverage if employer contributions will end.

- Explore alternative coverage options through a spouse’s plan, the marketplace, or medicaid.

- Apply for SDI benefits quickly if your disability is eexpectedto last astatine least 12 months.

- Create a timeline note important dates, such as when FMLA protection end, when employer contributions might stop, and when medicare eligibility would begin if approve for SDI.

- Set up a system for timely premium payments to prevent coverage lapses.

Take these steps can help ensure continuous health coverage during your disability period.

Conclusion

The question of who pay for health insurance during long term disability doesn’t have a simple, universal answer. The responsibility typically shifts over time, start with your employer during FMLA leave and potentially transition to you through cobra or marketplace coverage until medicare eligibility begin through SDI.

Understand your specific benefits, employer policies, and available alternatives allow you to make informed decisions about maintain crucial health insurance coverage during disability. By plan beforehand and know your options, you can focus on recovery instead than worry about how to pay for necessary medical care.

MORE FROM gowithdeal.com