Health Insurance Benefits Clause: Understanding Your Policy’s Payment Terms

Health insurance benefits clause: understand your policy’s payment terms

When will navigate the complex world of health insurance, understand which clause will specify the benefit will amount you will receive is essential. This knowledge help you make informed decisions about your healthcare and prevent unexpected financial burdens.

The schedule of benefits: your primary payment reference

The

Schedule of benefits

Is the primary clause in health insurance policies that will specify precisely how much the insurer will pay for covered services. This critical section outline:

- Dollar amounts or percentages cover for each service category

- Maximum payment limits for specific treatments

- Coverage differences between in network and out of network providers

- Deductible amounts you must pay before insurance coverage begin

- Coinsurance percentages that determine cost sharing between you and the insurer

- Co-payment amounts require at the time of service

The schedule of benefits functions as a comprehensive reference table that translate your policy’s broader coverage promises into specific dollar amounts or percentages. It will serve as the definitive source when it will determine how much your insurer will pay for any covered service.

Benefits payment provision: the legal framework

While the schedule of benefits provide the specific amounts, the

Benefits payment provision

Establish the legal framework for how these payments work. This clause typically includes:

- Methods used to calculate payments( such as percentage of usual and customary charges)

- Timing of benefit payments

- Conditions that must be meet before payment occur

- Procedures for submit claims

- Circumstances under which benefits might be reduced or deny

The benefits’ payment provision work in conjunction with the schedule of benefits to create a complete picture of your financial responsibilities and insurance coverage.

Maximum benefit clause: set upper limits

The

Maximum benefit clause

Will specify the total amount your insurance will pay, either for specific services or boiler suit during the policy period. This clause may include:

- Lifetime maximums for certain conditions or treatments

- Annual maximum benefits across all services

- Per incident maximum payments

- Service specific maximums (such as for mental health or physical therapy )

Since the Affordable Care Act implementation, many traditional lifetime and annual limits have been prohibited for essential health benefits. Notwithstanding, maximum benefit clauses may notwithstanding apply tnon-essentialal services or igrandfatherre plans.

Usual, customary, and reasonable (uUCI)clause

The

UCI clause

Importantly impact benefit payments, specially for away of network services. This provision will state that the insurer will solely pay what they’ll determine to be the usual, customary, and reasonable charge for a particular service in your geographic area.

For example, if you’rout-of-networkrk surgeon will charg$5 5,000 for a procedure, but the insurer will determine theUCIr amount is solely$33,500, your benefit calculation will be will base on the lower amount. If your policy cover 70 % of out of network costs, the insurer would pay $2,450 ((0 % of $ $300 ),)ot 70 % of the full $ 5,$5 charge.

Understand the UCI clause is crucial because it can create significant gaps between what providers charge and what insurance cover, particularly for out of network care.

Exclusions and limitations: what’s not cover

While not direct specify payment amounts, the

Exclusions and limitations

Clause dramatically affect benefits by establish which services receive no payment at wholly. Common exclusions include:

- Cosmetic procedures

- Experimental treatments

- Services deem not medically necessary

-

Pre-exist conditions ( i(some policies )

) - Self inflict injuries

Yet cover services may face limitations, such as restrictions on the number of covered visits or treatments per year. These limitations efficaciously set the benefit amount at zero once you exceed the specify limit.

Cost sharing provisions: your financial responsibility

Several cost share provisions work unitedly to determine the actual benefit amount pay by your insurance:

Deductible clause

The

Deductible clause

Specify the amount you must pay out of pocket before your insurance begin pay benefits. For example, with a $2,000 deductible, your insurer pay nothing ((xcept for certain preventive services ))ntil youyou’ve spent2$20 on cover healthcare expenses.

Coinsurance clause

After meet your deductible, the

Coinsurance clause

Will determine what percentage of will remain costs the insurer will cover. Common coinsurance arrangements include 80/20 (insurer pay 80 %, you pay 20 % )or 70/30 splits.

Co-payment clause

The

Co-payment clause

Establishes fixed dollar amounts you pay for specific services, disregarding of the actual cost. For example, $25 for primary care visits or $$50for specialist appointments.

Out of pocket maximum clause

The

Out of pocket maximum clause

Set a cap on your annual spending. East reach, your insurer covers 100 % of additional cover expenses for the remainder of the policy period.

These cost share provisions jointly determine the actual benefit amount your insurer pay versus what you pay.

Network provisions: provider based benefit determination

For manage care plans like Amos and pops,

Network provisions

Importantly impact benefit amounts base on which providers you use:

-

In network benefits

typically higher payment percentages ((uch 80 100 % ))or providers who have contract with your insurer -

Out of network benefits

considerably lower payment percentages ((uch 50 70 % ))or non contract providers -

Tiered network benefits

vary payment levels base on provider tiers ((ith preferred providers receive higher benefit payments ))

Some plans may pay nothing for away of network care except in emergencies, efficaciously set those benefit amounts at zero.

Per diem and case rate provisions

For hospital stays and complex procedures, many policies include

Per diem

Or

Case rate provisions

That specify fix payment amounts:

-

Per diem

a set daily rate the insurer pay for each day of hospitalization, irrespective of actual charges -

Case rates

fix payments for entire episodes of care ((uch as childbirth or heart surgery ))

These provisions simplify benefit calculations but may create gaps if your actual costs exceed the predetermine rates.

Rider provisions: supplemental benefit specifications

Riders

Are supplemental policy provisions that modify standard benefits, oft add coverage for services that would differently be excluded or limited. Common riders include:

- Prescription drug riders specify medication coverage

- Dental and vision benefit riders

- Maternity coverage riders

- Alternative medicine benefit riders

Each rider include its own benefit payment specifications, which may differ from the main policy’s payment structure.

Pre-authorization and medical necessity clauses

While not direct state benefit amounts,

Pre-authorization

And

Medical necessity

Clauses can reduce benefits to zero if not follow right:

- Pre-authorization requirements mandate advance approval for certain services

- Medical necessity provisions require that services be deemed necessary by the insurer

Failure to obtain required pre-authorization or have a service deem not medically necessary can result in importantly reduce benefits or complete denial of payment.

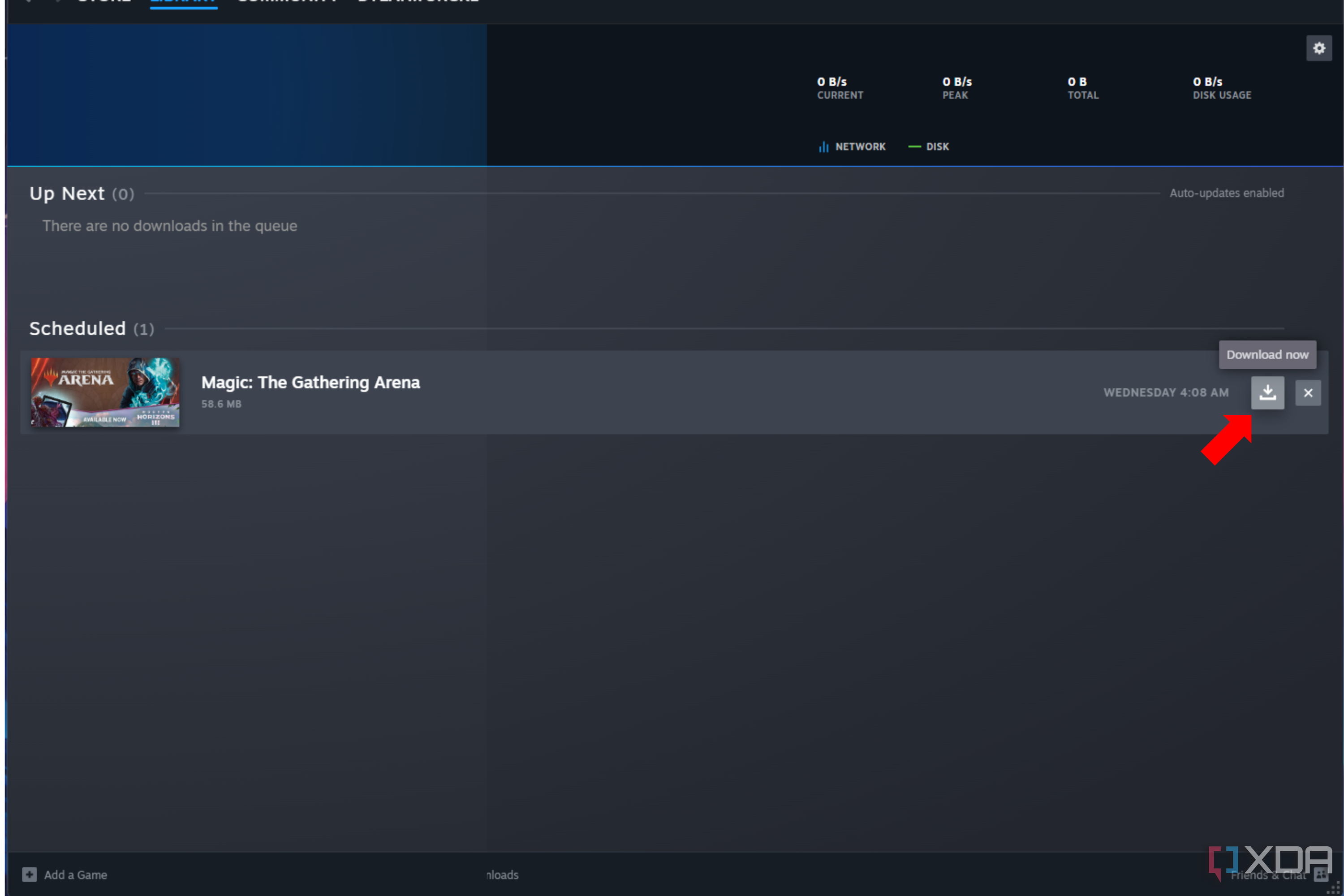

How to interpret your policy’s benefit payment clauses

To accurately will determine how much your insurance will pay for healthcare services:

Source: dexform.com

-

Start with the schedule of benefits

To identify the basic payment structure -

Check network status

Of your provider to determine which benefit level apply -

Consider your current deductible status

To see if benefits have begun -

Apply the appropriate coinsurance percentage

Base on service type -

Verify any service specific limitations

That might reduce benefits -

Confirm pre-authorization requirements

Have been meet -

Review any applicable riders

That might modify standard benefits

For complex procedures or expensive treatments, consider request a pre determination of benefits from your insurer, which provide an estimate of covered amounts before you receive services.

Common misunderstandings about benefit payment clauses

Many policyholders misinterpret benefit payment provisions, lead to unexpected costs:

-

Assumption that” cover ” eans “” y in full ”

”

yet cover services are subject to deductibles, coinsurance, and limitations -

Confusion between allow amounts and actual charges

benefits are typically calculate base on allow amounts, not provider charges -

Overlook service specific limitations

some services have unique payment rules that differ from the standard policy structure -

Misunderstand the interaction between multiple clauses

several provisions work unitedly to determine the final benefit amount

Take time to understand how these clauses interact can prevent financial surprises.

Questions to ask your insurer about benefit payments

When will clarify how much your insurance will pay for specific services, will ask:

- ” wWhats the allow amount for this procedure with this provider? ”

- ” hHowwill my deductible and coinsurance will affect the payment amount? ”

- ” aArethere any service specific limitations that apply? ”

- ” wWillany part of this treatment potentially be will consider not medically necessary? ”

- ” cCaniIreceive a written pre determination of benefits? ”

Document all conversations with your insurer, include representative names and reference numbers.

Source: healthbenefited.com

Conclusion: the interplay of multiple benefit clauses

No single clause in your health insurance policy solely determine benefit amounts. Alternatively, several provisions work unitedly to establish payment terms. The schedule of benefits serves as the primary reference point, but payment amounts aremodifiedy by network status, cost sharing requirements, service limitations, and medical necessity determinations.

Understand this complex interplay help you anticipate your financial responsibility and make informed healthcare decisions. When in doubt, contact your insurer direct for clarification about specific benefit payments before receive expensive or complex medical services.

By familiarize yourself with these key policy provisions, you can advantageously navigate the healthcare system, avoid unexpected costs, and maximize the value of your health insurance coverage.

MORE FROM gowithdeal.com