Understanding Earnings: How Much Do Health Insurance Agents Make in 2025?

Introduction: The Earning Potential of Health Insurance Agents

The health insurance industry remains a cornerstone of financial security for millions of Americans, and health insurance agents play a pivotal role in connecting clients with suitable coverage options. If you are considering a career in this field or evaluating your current compensation, understanding how much health insurance agents make-and the factors that influence their earnings-is essential. This article provides a comprehensive, current overview of agent salaries, commission structures, career advancement strategies, and actionable guidance for maximizing your income in 2025.

Average Salary and Pay Structure for Health Insurance Agents

Health insurance agents in the United States typically earn a combination of base salary and commissions. According to recent data, the average hourly wage for a health insurance agent is $26.51 , with most agents earning between $20.19 (25th percentile) and $30.53 (75th percentile) per hour. Hourly wages can range as low as $11.78 and as high as $59.38 depending on location, experience, and performance [1] . This translates to an approximate annual salary range of $32,000 to $73,000 for most agents, with top performers exceeding these figures [2] .

Median annual wages reported by the Bureau of Labor Statistics for insurance sales agents, which includes health insurance agents, stood at $60,370 in May 2024 [5] .

Commission Structure and Earning Opportunities

Unlike many salaried positions, health insurance agents often derive a substantial portion of their income from commissions. These commissions are paid by insurance carriers based on the value of policies sold and renewed. First-year commissions for new policies, especially in health and life insurance, can be significant, while renewals typically yield lower but steady income [4] .

For example, some agents report annual earnings in the $50,000 to $95,000 range, depending on their sales volume and client base. Entry-level agents may start around $39,000, while experienced agents with strong networks and sales skills can earn well above $100,000 annually [4] .

Source: melissa.depperfamily.net

Factors Affecting Health Insurance Agent Earnings

Several key factors influence how much health insurance agents make:

- Experience Level: Entry-level agents generally earn less, with average total compensation around $38,000. Agents with 1-4 years of experience average $43,858, while top earners can reach $73,000 or more [2] .

- Location: Geographic differences impact pay. For instance, agents in Wisconsin report average annual salaries of $65,630, with top earners bringing in over $100,000 [3] .

- Sales Performance: Commissions directly correlate with the number and value of policies sold. Agents specializing in high-value products or who build larger client bases tend to earn more.

- Agency Type: Agents working for large national firms may have access to better leads and higher commission percentages, while independent agents have flexibility but face more competition.

- Education and Certifications: Advanced degrees and professional certifications can qualify agents for higher-paying roles and promotions [2] .

Career Advancement and Increasing Your Earnings

Health insurance agents seeking to maximize their income should consider several actionable strategies:

- Skill Development: Invest in sales training, negotiation skills, and product knowledge to boost your close rates and customer retention.

- Networking: Building relationships with local businesses, community organizations, and referral partners can expand your client base and increase sales opportunities.

- Specialization: Focusing on niche markets-such as Medicare, group health plans, or small business coverage-can open higher-commission opportunities and reduce competition.

- Licensing and Certification: Pursue additional state licenses, continuing education, and industry certifications to qualify for advanced roles and broader product portfolios.

- Consider Relocation: If feasible, relocating to regions with higher average salaries or greater demand for health insurance agents may boost your earning potential [1] .

Practical Steps to Start or Advance Your Career

If you are interested in becoming a health insurance agent or increasing your earnings, here are step-by-step instructions:

- Research State Requirements: Each state has unique licensing requirements. Visit your state’s Department of Insurance website and search for “health insurance agent licensing” to find official application forms, study materials, and exam dates.

- Complete Pre-Licensing Education: Most states require completion of pre-licensing courses, which are available through accredited providers. These programs cover insurance fundamentals, ethics, and relevant laws.

- Pass the Licensing Exam: Register for and pass the state-mandated licensing exam. Testing centers and schedules are listed on your state’s Department of Insurance website.

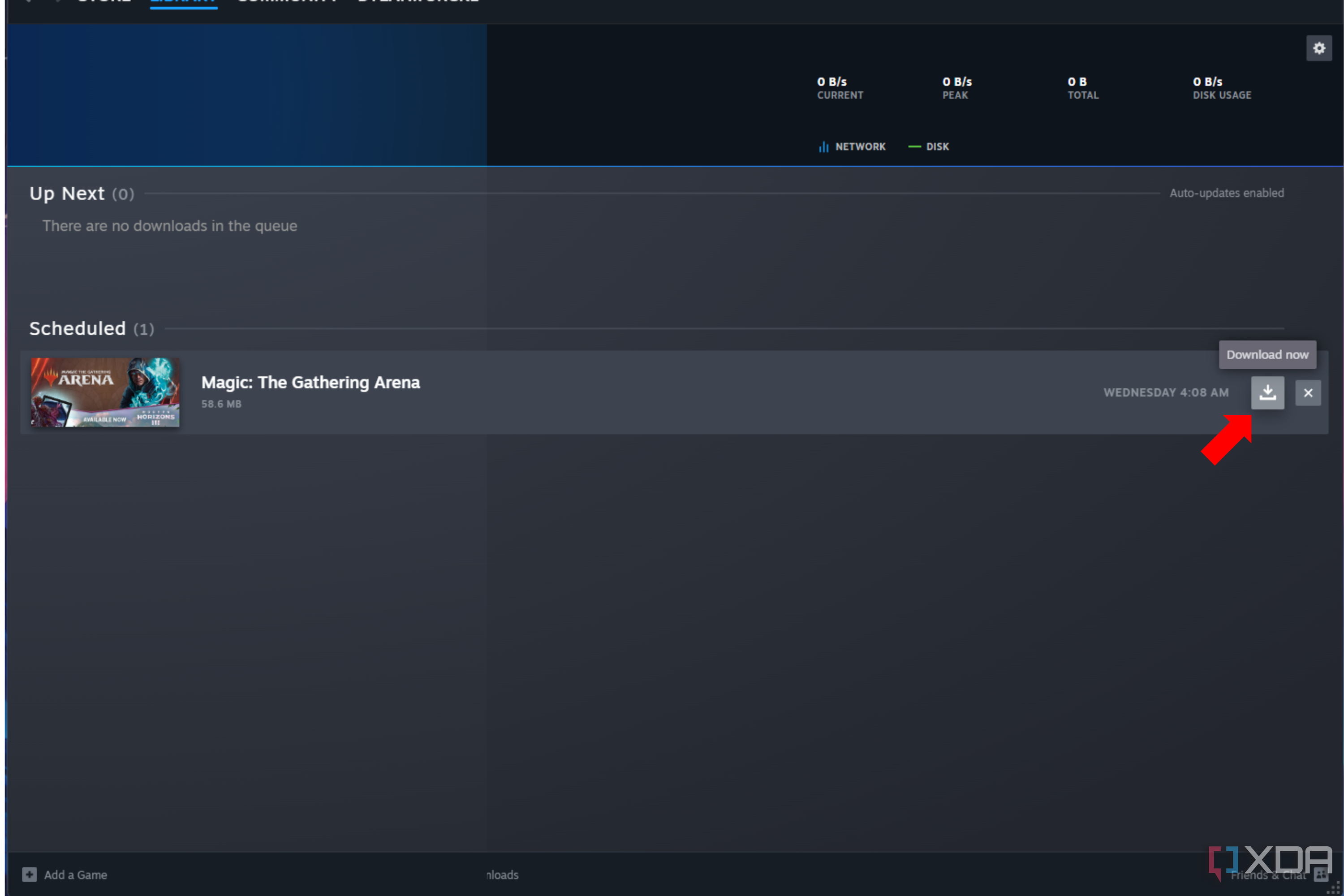

- Apply for Jobs: Search for health insurance agent positions through established job boards (such as ZipRecruiter or Indeed), insurance company career pages, and local agency listings. Be sure to review compensation packages, including base salary, commission structure, benefits, and training opportunities.

- Build Your Book of Business: Start by reaching out to friends, family, and professional connections. Attend local networking events, join business associations, and utilize online marketing strategies to attract clients.

- Maintain Compliance: Stay current with continuing education requirements and renew your license as required by your state.

For additional support, consider joining professional organizations such as the National Association of Health Underwriters (NAHU) and attending industry conferences for networking and professional development.

Addressing Common Questions and Challenges

Is Being a Health Insurance Agent a Good Career? Overall, health insurance agents enjoy above-average earning potential and job growth, with employment projected to grow 6% from 2023 to 2033 [5] . However, success depends on your ability to sell policies, build lasting client relationships, and adapt to changing industry regulations.

What Are the Challenges? New agents often face steep competition, fluctuating income, and the need to build credibility. Overcoming these hurdles requires persistence, continuous learning, and effective sales strategies. Many agents report that income increases substantially after the first few years as they gain experience and expand their client base [2] .

How Can You Find High-Paying Opportunities? To identify high-paying health insurance agent positions, use major job boards with robust search filters. Look for opportunities with established insurance carriers that offer comprehensive benefits and competitive commission structures. Consider negotiating your compensation package and seeking out employers known for professional development and advancement.

Alternative Pathways and Related Careers

Health insurance agents who wish to diversify or advance their careers might explore related roles such as:

- Insurance brokers, who may represent multiple carriers and offer broader product selection.

- Underwriters, who assess insurance applications and determine coverage terms.

- Agency managers, who oversee teams of agents and receive higher salaries plus performance bonuses.

Each of these roles requires additional training, experience, and in some cases, further licensing. Research requirements on official agency websites and professional associations for accurate guidance.

How to Access Resources and Support

If you are seeking more detailed information or support for becoming a health insurance agent, you can:

- Contact your state Department of Insurance for licensing guides and official application forms.

- Search for “health insurance agent jobs” on reputable job boards like ZipRecruiter or Indeed.

- Join industry organizations such as NAHU for professional networking and continuing education.

- Attend local business expos and career fairs to connect with potential employers and clients.

Remember, successful agents continually invest in their professional development, stay up-to-date with regulatory changes, and actively seek out growth opportunities.

Key Takeaways

Health insurance agents in 2025 can expect earnings that reflect their experience, location, sales performance, and specialization. With median annual wages around $60,000 and top performers earning over $100,000, this career offers substantial financial rewards for those willing to build expertise and client relationships. Commissions remain a critical component of overall compensation, making sales skills and proactive networking essential. For those interested in entering or advancing in the field, following state licensing procedures, investing in training, and leveraging industry resources are actionable steps toward success.

References

- [1] ZipRecruiter (2025). Health Insurance Agent Salary: Hourly Rate August 2025.

- [2] PayScale (2025). Insurance Agent Salary in 2025.

- [3] ZipRecruiter (2025). Salary: Insurance Agent in Wisconsin (August, 2025).

- [4] AgencyHeight (2025). Insurance Agent Salary: Know Your Earnings.

- [5] Bureau of Labor Statistics (2025). Insurance Sales Agents: Occupational Outlook Handbook.

MORE FROM gowithdeal.com