Are Tesla Prices Dropping? 2025 Market Trends, Analysis, and Buyer Guidance

Understanding Tesla Pricing Trends in 2025

The question of whether Tesla prices are dropping in 2025 is top-of-mind for prospective buyers, investors, and industry observers. As electric vehicles (EVs) become more mainstream, pricing dynamics for Tesla’s lineup have shifted in response to market competition, manufacturing costs, and government incentives. To make an informed purchase or investment decision, it’s essential to understand these trends, their underlying causes, and actionable strategies you can use to access the best possible value.

Current 2025 Tesla Price Ranges

As of 2025, Tesla’s lineup includes the Model 3, Model Y, Model S, Model X, and the Cybertruck. Base prices across the range start from about $42,490 for the Model 3 and climb to nearly $99,990 for the top Model X and Plaid variants. Customizations such as upgraded wheels, premium interiors, and Full Self-Driving (FSD) software can add thousands to the final sticker price. For example, a fully optioned Model X Plaid can approach $113,990 [1] .

The Model 3, Tesla’s entry-level sedan, now starts at $44,130 for the 2025 model year, with upper trims and options raising the price to approximately $56,630 [3] . The Model Y Long Range All-Wheel Drive, a popular SUV variant, is generally priced between $47,990 and $49,990 depending on region and configuration [5] . The range for new Teslas is therefore quite broad, reflecting different trim levels, technology packages, and performance upgrades.

Have Tesla Prices Dropped Recently?

In recent years, Tesla has made several high-profile pricing adjustments in response to shifting market conditions. While Tesla is known for occasionally raising prices due to supply chain constraints, inflation, or increased material costs, the company has also implemented significant price cuts at key moments to stimulate demand or respond to increased competition in the EV market.

For example, over the past two years, Tesla reduced prices on several models, including the Model 3 and Model Y, at various points. These reductions were often in response to slower-than-expected demand or competitive pressure from other automakers launching affordable electric vehicles. However, as of mid-2025, Tesla has also

discontinued

its Standard Range Model 3, replacing it with a higher-priced base variant

[3]

. This move means that, although some trims have seen price cuts, the overall entry-level price of owning a new Tesla has

not

dropped as sharply as some headlines might suggest.

According to recent published guides, the Model 3 Rear-Wheel Drive remains the most affordable Tesla, starting at $42,490, which is still lower than the current average electric car price of about $55,000 [2] . However, the elimination of certain lower-priced trims means buyers may find themselves paying more for entry-level models than in previous years.

Source: automotiveglory.com

Key Factors Influencing Tesla Pricing

Several major factors influence whether Tesla prices drop or rise:

- Market Competition: The influx of new EV models from competitors like Hyundai, Kia, and legacy automakers often pressures Tesla to adjust pricing to stay competitive. For instance, the 2025 Hyundai Ioniq 6 and Kia EV4 start at approximately $39,000, undercutting Tesla’s Model 3 base price [3] .

- Production Costs: Fluctuations in the cost of raw materials (such as lithium for batteries), labor, and logistics directly affect pricing. When production costs decrease, Tesla may pass savings on to consumers.

- Government Incentives: The U.S. federal EV tax credit of $7,500 is available for certain Tesla models, directly lowering the effective purchase price for qualifying buyers. However, luxury models like the S and X may not be eligible due to price caps [1] .

- Inventory and Demand Cycles: Tesla sometimes lowers prices to clear inventory, especially at the end of quarters or when new model years are introduced.

How to Access Discounts and Savings on a Tesla

Despite the headline sticker prices, there are several ways potential buyers may be able to secure a lower price or added value:

- Leverage Federal and State Incentives: Many buyers can qualify for the federal $7,500 EV tax credit. Some states and localities offer additional rebates or incentives. To determine your eligibility, visit the official IRS website or your state’s Department of Transportation portal and search for “EV tax credit” and “state EV incentives.” Always confirm with your tax professional before making a purchase.

- Consider Certified Pre-Owned or Used Teslas: The used Tesla market has grown, and prices can be noticeably lower than new vehicles, especially for prior model years. Search through Tesla’s official used inventory or reputable automotive marketplaces.

- Monitor End-of-Quarter Offers: Tesla is known for pushing sales at the end of fiscal quarters, occasionally offering discounts or free upgrades to spur demand. Stay updated by following Tesla’s official news, social media accounts, or subscribing to automotive news alerts.

- Check for Referral Programs: Tesla has, in the past, provided referral bonuses or incentives for new buyers. These programs may change or be discontinued, so it’s advisable to check Tesla’s official website or ask a local Tesla advisor.

Case Study: Comparing Tesla With Other EVs

The current market landscape for electric vehicles is highly competitive. For example, the 2025 Tesla Model 3 starts at $44,130, while the Hyundai Ioniq 6 begins at $39,095, and the Nissan Leaf at $29,280. These alternatives may offer lower starting prices but differ in technology, range, and features. Tesla continues to lead in driving range, software integration, and charging infrastructure, which can justify a higher price point for some buyers [4] .

When considering a Tesla, weigh the long-term value, including technology updates, Supercharger network access, and resale value, against up-front costs. For some buyers, paying a premium for these benefits may be worthwhile, while others may prioritize a lower initial investment.

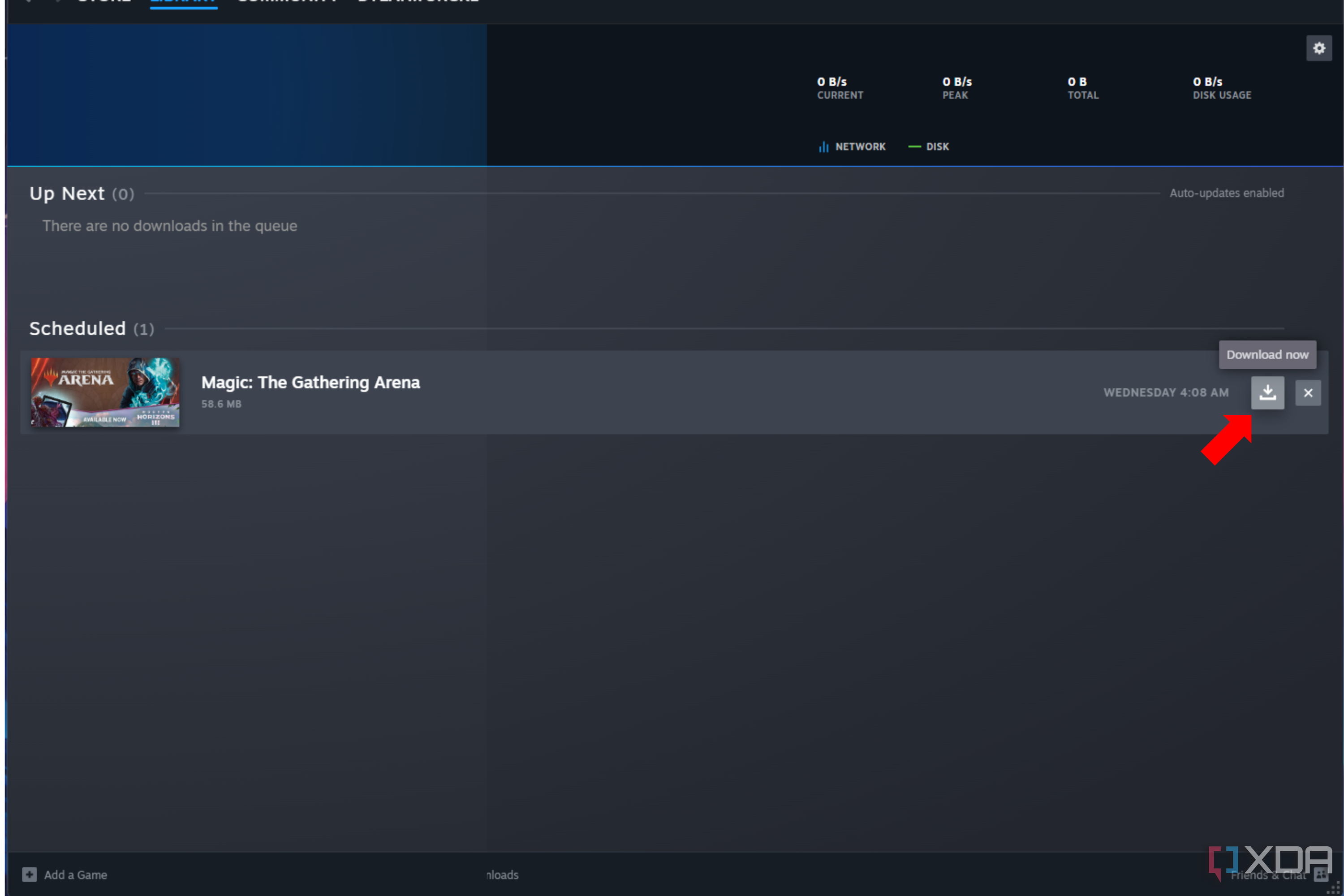

Step-By-Step Guide to Getting the Best Tesla Deal

1. Research Models and Trims: Identify which Tesla model best fits your needs and budget. Use official resources, like Tesla’s website, and compare with reputable automotive guides.

2. Calculate Total Cost of Ownership: Consider not just the purchase price, but also incentives, estimated electricity costs, insurance, maintenance, and projected resale value. Many third-party sites offer calculators to help project these expenses.

3. Check for Incentives: Visit the official IRS website for federal tax credit information. For state and local incentives, search your state’s Department of Transportation or Energy websites. If you’re unsure, consult with a tax advisor.

4. Compare Financing and Leasing Options: Tesla offers both financing and leasing. Compare these with offers from third-party lenders or your local bank. Consider term length, down payment, and interest rates to find the best fit.

5. Monitor Price Changes: Tesla may adjust prices throughout the year. Set up alerts on automotive news sites or check Tesla’s website regularly for potential drops or special promotions.

6. Consider Used Inventory: Explore Tesla’s certified pre-owned options or other reputable used car platforms. Used models can offer significant savings, especially if prior owners have already used up FSD or premium connectivity options.

7. Contact a Local Tesla Advisor: For personalized guidance, schedule a test drive through Tesla’s website or visit a local showroom. Advisors can provide current pricing, inventory, and any available incentives.

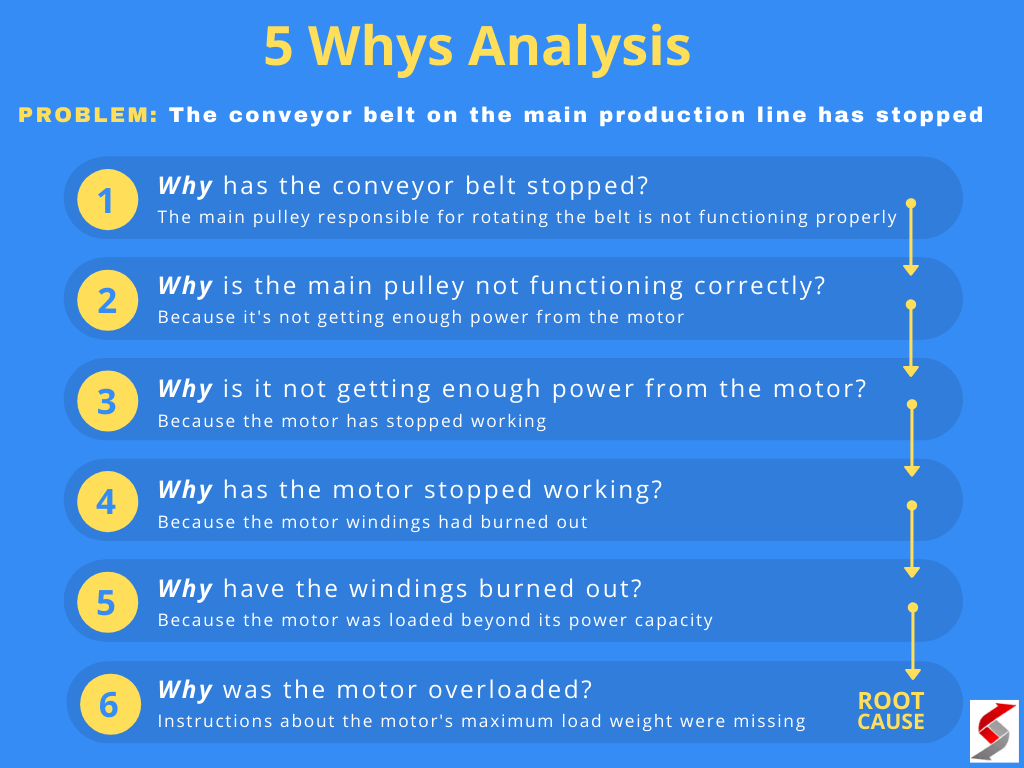

Potential Challenges and Solutions

One challenge with Tesla pricing is volatility. Prices can change with little notice, leading to frustration for buyers who delay their purchase. To mitigate this, act quickly when you see a price that fits your budget and ensure you have pre-approval for financing or the required funds ready.

Another challenge is eligibility for federal or state incentives, which can change based on model, price, or legislative updates. Always verify eligibility before making a commitment. If a desired model does not qualify, consider alternative trims or certified used vehicles.

Alternative Approaches to Affordability

If the current pricing is above your budget, consider the following alternatives:

- Look for older model years or vehicles with higher mileage, which often come at a discount.

- Explore lease takeovers, where you assume the remainder of someone else’s lease, sometimes at favorable terms.

- Evaluate non-Tesla EVs that may offer better pricing or incentives. Many new models in 2025 provide compelling value, especially in the compact SUV and sedan segments.

Summary and Key Takeaways

While Tesla prices have dropped on some models and trims in recent years, the overall entry-level cost has not decreased significantly in 2025, especially with the elimination of certain lower-priced variants. Incentives and competition continue to shape the landscape, and savvy buyers can still access meaningful savings by leveraging tax credits, exploring used inventory, and staying alert for manufacturer promotions. Carefully research and compare your options, and consider reaching out to an official Tesla advisor for the most up-to-date offers and guidance.

Source: seekingalpha.com

References

- [1] Find My Electric (2025). How Much Does a Tesla Cost in 2025? New & Used Prices!

- [2] SolarReviews (2024). How Much is a Tesla? 2025 Costs and Comparisons

- [3] Car and Driver (2024). 2025 Tesla Model 3 Review, Pricing, and Specs

- [4] Kelley Blue Book (2025). 2025 Tesla Model 3 Price, Reviews, Pictures & More

- [5] Arka360 (2025). How Much is a Tesla in 2025? Complete Price Guide for All Models

MORE FROM gowithdeal.com