Car Part Exchange While on Finance: Complete Guide to Your Options

Understand part exchange for financed vehicles

Part exchange a car that’s stock still on finance is whole possible, but it involves some additional steps compare to trading in a full own vehicle. Many drivers find themselves want to upgrade their car before they have finish pay off their current finance agreement, and dealerships are mostly equip to handle these situations.

The key consideration is that the outstanding finance must be settled before ownership can be transfer. This typically happen as part of the part exchange process, but understand howitsworksrk can help you navigate the transaction more efficaciously.

How part exchange work with a finance car

When you part exchange a car that’s stock still on finance, the basic process follows these steps:

1. Vehicle valuation

The dealer will assess your current vehicle and will provide a part exchange value. This valuation take into account factors like age, mileage, condition, service history, and current market demand.

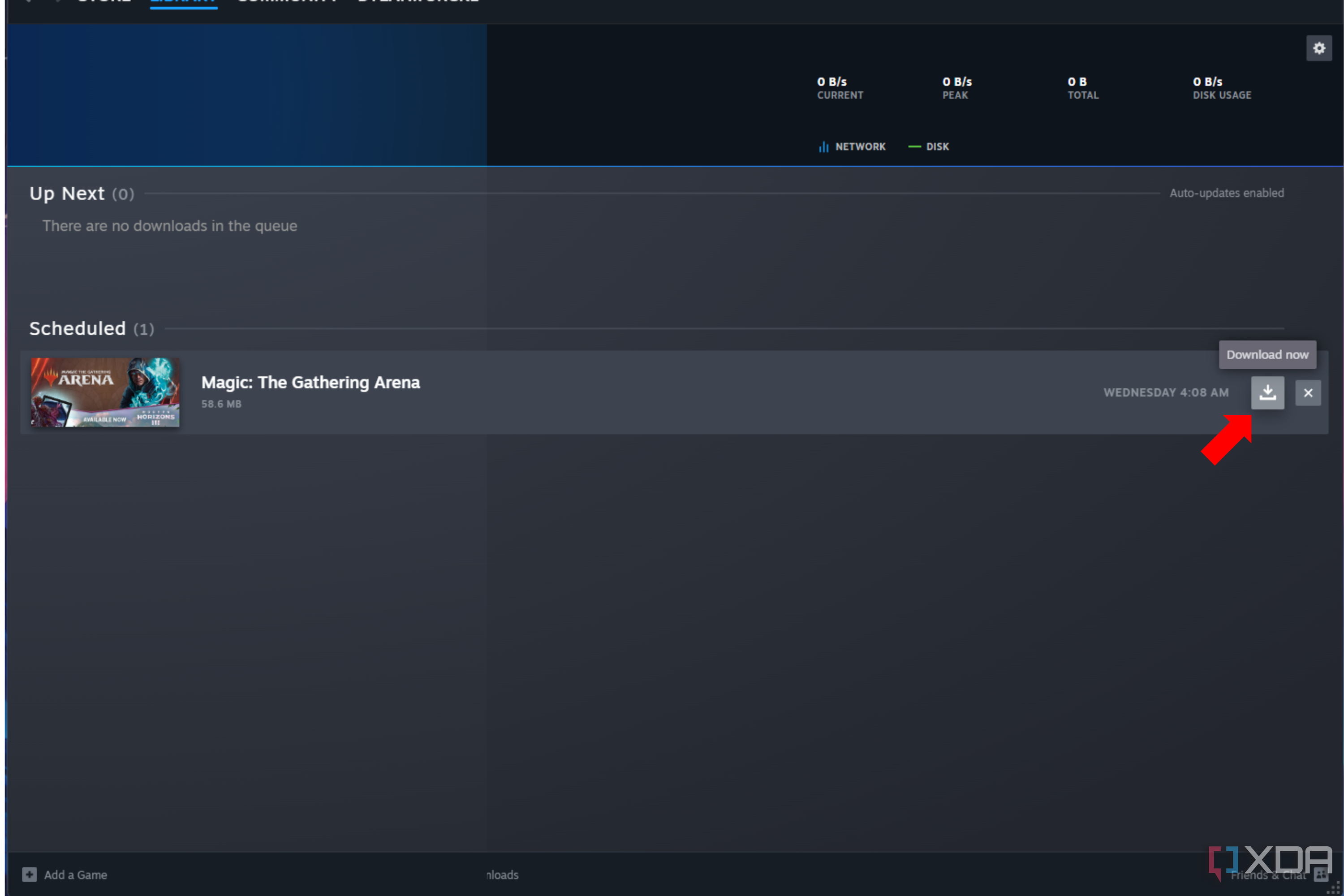

Source: carfinancesaver.co.uk

2. Finance settlement figure

You will need to will contact your finance company to will request a settlement figure. This is the amount require to payingf your finance agreement in full, include any early repayment fees that might apply.

3. Equity calculation

The dealer will compare your car’s valuation against the settlement figure:

-

Positive equity:

If your car is worth more than the remain finance, the difference can contribute toward your new vehicle. -

Negative equity:

If you’ll owe more than the car is worth, this shortfall will need to be will cover, either by pay it singly or by will incorporate it into the finance agreement for your new vehicle.

4. New finance agreement

Once the equity situation is clear, the dealer will arrange the new finance agreement, take into account any positive equity contribution or negative equity that will need to be will absorb.

Different finance types and their impact on part exchange

The type of finance agreement you’ve will affect how straightforward the part exchange process will be:

Personal contract purchase (pPCP)

PCP agreements are design with flexibility in mind, make them comparatively straightforward for part exchange:

- You can part exchange at any point during the agreement

- The settlement figure include the remain monthly payments plus the balloon payment

- Many drivers part exchange toward the end of their PCP term kinda than pay the balloon payment

If you’re within the last few months of your PCP agreement, it might be worth check if you have any equity building in the vehicle, as this could provide a larger deposit for your next car.

Hire-purchase ( ( )

)

With hp agreements:

- You don’t own the vehicle until the final payment is make

- The settlement figure is more straightforward as it’s merely the remain balance

- You mostly build equity firmer than witPCPcp, potentially give you more toward your next vehicle

Personal contract hire (pPC/lease

Lease present more challenges for part exchange:

- You ne’er own the vehicle, then traditional part exchange isn’t possible

- Early termination fees can be substantial

- You’ll typically will need to see out your lease agreement before get a new vehicle

Some lease companies offer early upgrade programs, but these aren’t technically part exchanges in the traditional sense.

Deal with negative equity

Negative equity occur when you owe more on your finance agreement than your car is presently worth. This situation is peculiarly common in the first half of finance agreements due to vehicle depreciation.

Options for handling negative equity

If you find yourself in negative equity, you have several options:

-

Pay off the difference:

The cleanest solution is to pay the shortfall in cash, allow you to start fresh with your new finance agreement. -

Roll over the negative equity:

Many finance companies allow you to add the negative equity to your new finance agreement. This mean you’ll be will finance both your new car and they will remain debt on your old one. -

Wait until you reach positive equity:

If possible, continue with your current agreement until the finance owe equal or fall below the car’s value can put you in a stronger position. -

Voluntary termination:

If you’ve paid off at least 50 % of the total amount payable on yourPCPp or hp agreement, you may be able to will exercise your right to voluntary termination, though this won’t will help if you’ll want to directly get a new car.

Will roll over negative equity should be will approach with caution, as it mean you’ll be pay interest on your old debt equally advantageously as your new car, potentially put you in a cycle of negative equity.

Maximize your part exchange value

Still with finance stock still outstanding, there be steps you can take to ensure you get the best possible valuation for your current vehicle:

Preparation before valuation

-

Clean your car exhaustively:

First impression matter. A comfortably present car suggest it’s been comfortably care for. -

Address minor issues:

Fix small problems like bulbs or wiper blades that could detract from the valuation. -

Gather documentation:

Have your service history, mot certificates, and any receipts for work do ready to demonstrate the car’s maintenance record. -

Know your car’s market value:

Research online valuation tools to understand what your car should be worth before head to the dealership.

Time your part exchange

Strategic timing can impact the value you receive:

- Part exchange when your car is stock still desirable, but depreciation has slow

- Consider seasonal factors (e.g., convertibles may fetch more in spring / summer )

- If possible, aim to part exchange when you’ve positive or neutral equity

The legal aspects of part exchange a finance car

There be important legal considerations when part exchanges a car that’s stock still on finance:

Ownership transfer

Until the finance is settled, the finance company lawfullyownsn the vehicleThis isis mean:

- The dealer must settle the finance before they can lawfully sell your car

- The finance company must provide write confirmation that the agreement has been settled

- You must disclose to the dealer that the car is on finance

Full disclosure requirements

You’re lawfully obligate to:

- Inform the dealer that the car is subject to a finance agreement

- Provide accurate information about the vehicle’s condition and history

- Disclose any know faults or damage

Fail to disclose that a car is on finance could constitute fraud, as your atattemptedo sell something you don’t lawfully own.

Alternative options to consider

Part exchange isn’t your only option when you have a car on finance:

Sell privately

You can potentially get more money by sell privately, but this requires additional steps:

- Obtain permission from your finance company

- Arrange for the settlement to be pay direct to the finance company

- Complete the sale exclusively when the finance company confirms the settlement

This approach can be more complex but might yield a better financial outcome if you’re willing to manage the process.

Vehicle buying services

Companies that specialize in buy cars can handle finance vehicles:

- They oftentimes offer a streamlined process for settle finance

- The valuation may be lower than a dealer part exchange

- The convenience factor can be significant, with some offer same day payment

Voluntary termination

If you’ve paid at least 50 % of the total amount payable on yourPCPp or hp agreement, you maybe entitlede to voluntarily terminate the agreement under the consumer credit act 1974. This will allow you to will return the car without further payments, though you won’t will receive any money to put toward a new vehicle.

Practical steps for part exchange your financed car

Before visit dealerships

- Contact your finance company to request a settlement figure

- Research your car’s current market value use online valuation tools

- Calculate your equity position (car value minus settlement figure )

- Gather all vehicle documentation include finance agreement details

- Clean and prepare your car to maximize its value

At the dealership

- Be upfront about your car being on finance

- Provide the settlement figure from your finance company

- Negotiate the part exchange value base on your research

- Understand how any negative equity will be will handle

- Get the part exchange offer in writing

Complete the transaction

- Review the new finance agreement cautiously, peculiarly if negative equity is being roll over

- Ensure the dealer is handled the settlement of your exist finance

- Get write confirmation that your previous finance has been settled

- Check your credit report after a few weeks to confirm the old agreement show as settle

Common pitfalls to avoid

When part exchange a car on finance, be wary of these common mistakes:

-

Focus solely on the monthly payment:

Lower monthly payments on your new agreement might mask the fact that you’re pay more overall or that negative equity has been added. -

Ignore early repayment charges:

Some finance agreements include penalties for early settlement that can affect your equity position. -

Not shop about:

Dealer valuations can vary importantly, hence get multiple offers can lead to better outcomes. -

Rush the process:

Make hasty decisions about car finance can lead to unfavorable terms that affect your finances for years. -

Overlook the total cost:

Focus on the total amount you’ll pay over the entire agreement, not equitable the headline rate or monthly payment.

Final considerations

Part exchange a car on finance is a common transaction that dealerships handle regularly. With proper preparation and understanding of your financial position, you can navigate the process efficaciously.

Will remember that the key factors will affect your part exchange experience will be:

Source: mycarcredit.co.uk

- The type of finance agreement you presently have

- Your equity position (positive or negative )

- The condition and desirability of your current vehicle

- Your credit status for the new finance agreement

By approach the transaction with clear information and realistic expectations, you can make the transition to your new vehicle as smooth and financially sound as possible, still with outstanding finance on your current car.

MORE FROM gowithdeal.com